Arrrrr! 🏴☠️ Welcome to the free edition of Category Pirates. Every Wednesday, we publish radically different ideas with the goal of helping you create, design, and dominate your own category—in business and in life. If you enjoy this letter, we encourage you to check out some of our other favorites:

To hop aboard the pirate ship, subscribe below 👇

Dear Friend, Subscriber, and fellow Category Pirate,

What is Bitcoin?

If you ask Warren Buffet, Bitcoin is “rat poison squared.” If you ask Tyler or Cameron Winklevoss, Bitcoin is “the sunlight that shines through the darkness of centralized money.” If you ask the 2017 version of Jamie Dimon, Bitcoin is “worse than tulip bulbs” and anyone who buys it is “stupid.” And if you ask the 2020 version of Jamie Dimon, Bitcoin is “not [my] cup of tea,” while J.P. Morgan’s Global Markets Strategy group calls Bitcoin “an emergence as an alternative to gold among millennials.”

So, which one is it?

In order to answer this question, we need to examine Bitcoin through a category lens.

A category lens is what we call examining a company, an asset, or an idea in the world not as it is, but in the context of its category.

For example, was Blockbuster a valuable company in 2007? Well, it depends on whether you are looking at the company through a category lens or not.

Through a category lens, Blockbuster was a financially successful company (9,000 stores and $5.5 billion in revenue) operating in a vulnerable and declining category (VHS movie rental). Which begs the question, was Netflix a valuable company in 2007? Again, it depends on whether you are looking at the company through a category lens or not. And through a category lens, Netflix was a booming startup ($1.25 billion in revenue and 7.5 million subscribers) with the leadership position in an exponentially more scalable, profitable, and quickly expanding category (digital streaming video).

Through a brand or P&L lens, Blockbuster was “more valuable on paper” that year.

But through a category lens, Netflix was massively undervalued and Blockbuster was a bloated, drunk incumbent asleep at the wheel. Not just because it was a superior business model via streaming and no late fees, but because it unlocked entirely new categories of video consumption. Blockbuster was just for movie night. Netflix, on the other hand, had massive category potential. It was on the cusp of unlocking weekend binge-watching for superconsumers and boredom relief during commuting.

Netflix was far more than just a substitute for Blockbuster.

When investors started looking at the company in the context of this new category, Netflix’s stock took off.

As we have written about in other Category Pirates letters, there is a business case to be made for becoming a category creator.

Category creators capture two-thirds (76%) of the economics of the new category.

For category creators, $1 of revenue growth = $4.82 of market cap growth (3x higher than non-category creators, where $1 of revenue growth = $1.77 market cap growth).

Category creators inevitably create new subcategories, which they are best positioned to further capitalize on (assuming their data flywheel is pointing them in the right direction and keeping them ahead of the curve).

It’s important to start with this “Winner Takes All” reality to business because it provides important context for how to look at Bitcoin.

When you bet on category creators and category designers, you are not just betting on the company or the asset or the idea. What you are betting on is the leadership position that company or asset or idea holds in the context of the emerging category.

This is how a venture capital firm like Andreesen Horowitz decides to inject $100 million into a new social app called Clubhouse with a valuation of a billion dollars. That valuation is not based on the P&L of the startup, or the “uniqueness of the brand.” That valuation is based on the category Clubhouse named & claimed they were creating—Drop-In, Spontaneous Audio—and their leadership position in it.

If Andreesen Horowitz is right, and Drop-In, Spontaneous Audio as a category becomes as big as they believe (worth tens, or maybe even hundreds of billions of dollars), the brand/company best positioned to capture two-thirds of the category’s economics is Clubhouse.

The flip side, of course, is that if the opposite happens—if people end up viewing Clubhouse as little more than a webinar hosting platform with forced appointment viewing just without the video—then the category will collapse and take Clubhouse with it.

Categories make companies. Not the other way around.

Which means the best way (for investors) to capture the economic growth of that category is to own as much equity as possible in the company that holds the leadership position in that emerging category.

Savvy VCs know this. Which is why (in part) there has been an explosion in startup unicorns. Lots of investors have been schooled to the game of winner-takes-all, and will do whatever it takes to get their piece of an emerging category king or queen with massive category potential.

If you look at Bitcoin through a brand lens, or a P&L lens, or even a “movement” lens, what is it?

It’s a clever idea. It’s a bubble.

It’s a way to transact money. It’s a digital currency.

It’s really hard to tell—just like it was really hard to tell how valuable Blockbuster was in 2007. Thousands of stores. Billions in revenue. “We delivered four consecutive quarters of positive same-store domestic movie rental revenues,” John Antioco, CEO of Blockbuster said at the end of that year. “We also significantly reduced operating costs, sizably increased our online subscriber base, and substantially improved our profitability and cash flow.”

3 years later, Blockbuster was dead. (And John was a moron.)

Now, it’s important to underscore: Value is a perception that gets created.

What people perceive as valuable today may or may not be viewed as valuable tomorrow.

There was a time in the mid-1970s when an entrepreneur named Gary Dahl convinced the world to pay $3.95 for a rock. He reportedly made over $15 million selling pet rocks. That is, before the perception changed and people decided they were…just rocks. And their value dropped.

Similarly, in the mid-2000s, Jack Dorsey showed Twitter to people for the first time, and most thought it was stupid. Today the company is worth $53 billion and Jack just auctioned off his first tweet for $2.5 million.

When perception changes, what people value changes.

Which means, when you look at the world through a category lens, you can see the future.

Now, let us tell you the story of Bitcoin’s perception change.

In 2012, the CEO of an enterprise business intelligence software company called MicroStrategy published a book called The Mobile Wave.

His argument was that “every company is becoming a software company, whether they like it or not—to the extent that they provide a good or a service that touches the consumer. So unless you have a diamond mine or an oil well, you better become a good software company. And clearly, Google, Facebook, Apple are the winners. The losers are companies that need to be great software companies and are either in denial and are hoping this is not going to happen, or they’re just incapable of developing great software skills.”

Saylor was looking at the future of technology through a category lens.

Software, and specifically mobile software, was going to dematerialize the physical world. Which meant companies with leadership positions (just like Netflix in 2007 with a leadership position in “digital streaming video”) in emerging categories capable of dematerializing incumbent categories were going to win.

And not just “win,” but winner-takes-all.

(If you invested in any of those companies ten years ago, you did very well for yourself.)

Eight years later, in 2020, Michael Saylor and MicroStrategy made headlines when they purchased $450 million worth of Bitcoin.

The pandemic hit in March. The world shifted.

Global companies moved 100% remote. Travel budgets were slashed to zero. But most importantly, the government’s response to the pandemic was to issue a $2 trillion economic relief package.

The problem? You can’t just print $2 trillion dollars out of thin air. Someone has to pay for it.

And even though this relief package meant publicly traded companies, small businesses, and individuals making less than $100k per year would receive forgivable loans and modest stimulus checks, it also meant sending the United States currency into an inflationary pressure cooker.

When a government prints more money, they make the existing money worth less. And if money is worth less, prices go up (specifically in scarce assets), which creates inflation. Which makes your money worth less. And so on, and so forth.

It’s a vicious cycle.

*Since this is a bit of a financial rabbit hole, we’re going to skip all the economic calculation stuff here. But if you want to get deep in the weeds, we recommend you listen to this We Study Billionaires podcast with Michael Saylor: A Masterclass In Economic Calculation.

The reason Saylor and MicroStrategy originally decided to buy Bitcoin with their balance sheet was:

The company was holding roughly $500 million worth of cash on its balance sheet.

The rate of inflation just spiked.

Assuming a modest 10% inflation rate in scarce assets over the next 5+ years, that would mean $500 million (in purchasing power) would turn into $450 million after year 1, $400 million after year 2, $350 million after year 3, and so on.

In ten years, all that cash the company worked so hard to acquire would be significantly devalued.

So the company went looking for a better store of value than cash, tech stocks, real estate, or bonds—all of which are pegged to an inflated dollar.

From the birth of Bitcoin in 2009, all the way up to the COVID-19 pandemic in 2020, Bitcoin was called a “currency.”

As a result, it has been very difficult for the masses to understand what Bitcoin “is.”

Calling it a currency was bad category design.

Is the bet that Bitcoin will be our currency-of-choice for buying coffee? Will it replace the US dollar? And what about that one guy in 2010 who paid 10,000 bitcoin for a pizza (which today would be worth about $500 million)? How is such a volatile asset ever going to become a viable “currency?”

Through a Currency Category Lens, Bitcoin was hard to value.

But change the category, and you change the perceived value.

It wasn’t until the COVID-19 pandemic that Michael Saylor, the Winklevoss twins, and even legacy banks trying to wrap their heads around the trillion-dollar asset started calling Bitcoin a “store of value.” In order to outpace inflation, investors, executives, family offices, and everyday Americans needed to find somewhere to hold their wealth. What were they looking for? A vehicle that was moving faster than the rate at which the country’s money was expanding. And despite Bitcoin’s volatility, the asset has returned 100%+ yearly returns for the past decade.

“Bitcoin isn’t a currency,” they started explaining to mainstream media. “Bitcoin is a bank in cyberspace. It’s a store of value.”

This is the definition of category design languaging: the strategic use of language to change thinking.

Through a brand lens, Bitcoin is a weird Internet-money phenomenon. Just like how, back in 2012 when Saylor published The Mobile Wave, Apple was just “an expensive luxury tech good.”

But whether you felt Apple devices were overpriced or not was besides the point. The only question was, in the context of the growing category, did Apple have the leadership position? And the answer was Yes. Which meant investors weren’t just betting on Apple, but more so Apple’s leadership position in the expanding category. After all, category potential drives the stock price of growth companies, not prior performance.

The same can (and should) be said about Bitcoin.

Bitcoin, in and of itself, is worthless (which has always been Warren Buffet’s argument against it). But this stance is devoid of category awareness. Through a “Store Of Value” category lens, Bitcoin is fungible digital real estate without the tax burdens, capable of being moved across the planet in a matter of minutes or seconds. It’s somewhere scarce to hold your wealth so it doesn’t get inflated into oblivion. It’s a savings account that goes up 100%+ per year.

When this becomes the lens through which the world values Bitcoin, all of a sudden, it’s very easy to imagine how the price of one single Bitcoin reaches $100,000 or $1,000,000 or even $10,000,000—no different than how it was easy for early Netflix investors to see how the company was going to grow from 7.5 million subscribers to 73 million subscribers. Through a category lens, you can see the future. Because as the new category grows, the company or entity or “movement” with the leadership position reaps two-thirds of the economics as its reward.

Which means, if you hold Bitcoin, you are not just betting on Bitcoin itself.

What you’re also betting on is Bitcoin’s leadership position in this new exciting and emerging Store Of Value category.

Michael Saylor explains Bitcoin in the context of this emerging category on the podcast, The Bitcoin Standard, and how Bitcoin goes from being a trillion-dollar asset class to being a ten-trillion or even hundred-trillion dollar Store Of Value asset class.

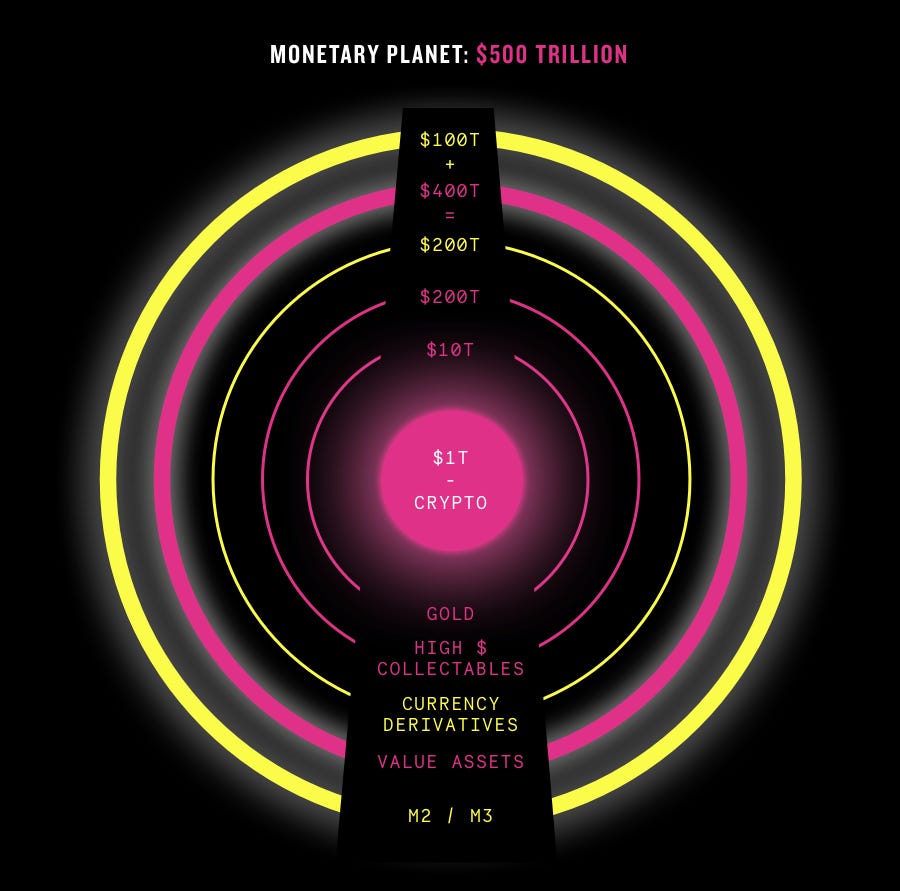

Here’s a visual for his overarching perspective of our Monetary Planet, and how crypto is the red-hot center slowly (but also quickly) redesigning and capturing the value of the larger “Store Of Value” categories outside it—starting first with gold.

(Segment begins at 1 hour, 16 minutes.)

To date, MicroStrategy has purchased $4.45 billion worth of Bitcoin.

Tesla has bought $1.5 billion.

Square has bought $170 million.

Even MassMutual, the 169-year-old insurance giant, has bought $100 million worth of Bitcoin.

Public companies, high net-worth individuals (like Ricardo Salinas Pliego, Mexico’s second-wealthiest man), family offices, and more are pouring into Bitcoin—because now they see things differently. “Oh, it’s not a currency. It’s a store of value.” The category lens shifted, and with it, the entire point of view of the world.

So, what is the value of Bitcoin? As a currency? As a store of value? As a hedge against global economic insanity and eroding trust in a US government that keeps printing more money, devaluing the dollar?

It depends on which lens you’re looking through.

Here’s what Bitcoin looks like through our Category Design Scorecard lens:

1. Category POV: Does the network have a clear “Point Of View” of the category? (2/2)

Yes. Overwhelmingly so.

Spend 10 minutes on Twitter and you’ll find a hive-mind of Bitcoin enthusiasts (from financial gurus to Reddit retail traders) all evangelizing the same mission: centralized money is broken. Government (globally) doesn’t have people’s best interests in mind and are capable of inflating anyone’s hard-earned wealth into oblivion. Take freedom into your own hands. Buy Bitcoin.

2. Future Category Reimagined & Without Compromise (2/2)

In a world where Bitcoin is the dominant store of value, there is no next-best alternative for moving and storing wealth.

Today, if we want to move $100 million in gold, we have to expend a significant amount of energy, time, resources—and, we have to ask for permission. With Bitcoin, you can move $100 million to anywhere in the world in a few minutes for a fraction of the cost. You can store it indefinitely. You can bring it with you to the airport, or across the ocean, without anyone knowing. It is the ultimate Store Of Value.

3. Radically Different Offer + Business Model (2/2)

Breakthrough product: Dematerialized gold. Weighs nothing. Perfectly scarce. No more than 21 million Bitcoin will ever be printed. It’s the hardest money to ever exist in the history of humanity.

Breakthrough offer: A savings account at a bank today yields less than half of 1%. With Bitcoin (even despite its volatility), your annual yield is north of 100%. And after the next decade, let’s assume it stabilizes to a yield of 30%, or 20%, or even 10%, Bitcoin is going to continue eating all the other legacy “Store Of Value” categories—which means, if this is true, Bitcoin will be a positive yielding Store Of Value for a very, very long time.

Breakthrough Business Model: Anyone can buy it regardless of race, gender, sexual orientation, citizenship, etc (very different from today’s banking system). Miners make money mining Bitcoin and verifying transactions. Users make money the longer they hold it.

4. Data Flywheel (2/2)

The more publicly traded companies that buy Bitcoin, the more data there is around who is holding large sums of Bitcoin and why.

When publicly traded companies buy Bitcoin, they (usually) are not buying with the intention of trading. They are buying it as a Store Of Value, which means they have no intentions of selling for at least 5-10+ years. In some cases, 30+ years. The more data there is here, the more other hodlers of Bitcoin will realize demand far exceeds supply—confirming their hypotheses that the price will continue to rise, encouraging them to buy more and hodl longer, further constraining supply, and so on.

5. Depth & Degree Of Customer Outcomes (2/2)

If you live in Argentina or Zimbabwe, wealth preservation is impossible.

Hyper-inflation in these countries means you aren’t able to save money faster than the rate at which it is being inflated out of your hands. For countries like Venezuela, Bitcoin is so much more than just a way of preserving wealth. It’s a vehicle to escape financial ruin and oppression—all from a mobile device.

Bitcoin produces life-changing customer outcomes.

Total score: 10/10

Now, we are in no way, shape, or form telling you what you should or should not do with your money. (Or your Bitcoin, for that matter.)

We are not investment advisors.

In addition, it’s important to remember that even the most promising breakthrough categories can sometimes vaporize. For a myriad of reasons. Remember when the Segway was going to transform personal transportation?

We share this letter with you for three reasons:

First, there is no question the digital world is racing to take over the physical world. And as that transformation continues to play out, we believe a category lens is a powerful tool for evaluating potential futures.

Second, we wanted to use Bitcoin to illustrate how you can use the Category Design Scorecard to evaluate any future category potential for yourself.

Third, Bitcoin is unquestionably a category creator—and right now, it is redesigning one of the largest categories on planet earth: the “Store Of Value” category.

And that warrants all of our attention.

Arrrrrrr,

Category Pirates

It's a shame that Bitcoin is lumped in with other cryptocurrencies. Seen from this category lens it's clear it is and will be very influential in the way we define what is valuable for years to come.

Great analysis.

Bitcoin is the most humanitarian Planetary Scale Digital Monument. Bitcoin is a disruptive technology that applies to many fields. It has hit the nerve of the financial system and brought hope to the people.Bitcoin technology is a network of trust and a source of energy.This groundbreaking discovery is not the future is the NOW!. Thank you so much for this serious, honest and different approach