Microsoft Office’s Legendary Data Flywheel: Why A Superconsumer Of 1 Category Is Also A Superconsumer Of 9

Here's your treasure map.

Arrrrr! 🏴☠️ Welcome to a free edition of Category Pirates. We publish radically different ideas to help you create, design, and dominate your own category—in business and in life. These aren’t long newsletters, these are short books.

If you’re new to Category Pirates, we encourage you to check out some of our other favorites:

To hop aboard the pirate ship, subscribe below 👇

Dear Friend, Subscriber, and fellow Category Pirate,

In one of our mini-books, we wrote about how to leverage Superconsumers for growth and category creation.

“Supers” are not just the key to unlocking category potential in one category. Supers can actually help point to new vistas of opportunity—breakthrough ideas, hiding in plain sight. But without the category lens, most people can’t see them.

So pour up a drink, lads and lassies.

It’s time to go head into Superconsumer Cove (legend has it there’s buried treasure in there!).

Category Lens Calculus: A Super of 1 is a Super of 9

A Superconsumer is the kind of person who knows your category better than anyone else—and as a result, is willing to spend 30% to 70% more with you than other less enthusiastic customers. The analogy we like to draw here is that if you are a Super of Pink Floyd, you don’t just buy The Dark Side Of The Moon record once. You buy it maybe a dozen times: you have the original record, a few unopened CDs, various digital copies across different devices, some live bootlegs, as well as one or two remastered versions. You’ve probably also bought copies to give as gifts to friends. You might even have a lunch box (Pirate Christopher has a Ramones one).

As a result, your “value” as a customer is exponentially higher than a fleeting listener who bought the record or CD once and then moved on.

That’s what makes you a Superconsumer.

What doesn’t get talked about enough is how powerful Superconsumers can be in unlocking exponential growth for your business in adjacent categories. Or even not so seemingly adjacent categories.

The reason is because a Super of 1 category is also a Super of up to 9 other categories as well. Pirate Eddie’s prior consulting firm, The Cambridge Group, which was acquired by Nielsen in 2009, gave him access to a treasure trove of data. Specifically, the Nielsen Homescan Panel which had up to 100,000 households in the US (and more around the world) that had agreed to scan the receipt of every purchase their household made. Data was gathered at the UPC level (universal product code), which meant one could measure not just that you were buying beer, but the beer category, style of beer, brand, pack size, and whether you bought it on sale or not. This was gathered across hundreds of categories totaling over $400 billion dollars in sales. (Comparable datasets were available around the world as well.) This was the world’s largest Rubik’s cube of consumer data, which Pirate Eddie used to discover this phenomenon.

Now, Sticking with our Pink Floyd analogy here, instead of trying to sell more The Dark Side Of The Moon records to more customers, you can actually grow revenues faster by selling more relevant products, services, and experiences to Pink Floyd Superconsumers in tangential and relevant categories.

This is a wallet share game, not a market share game.

Wallet share is about capturing more spending per customer.

Market share which is about capturing more spending in the category.

For the Pirates out there who like math more than music, think of Supers as the ultimate expression of lifetime value. The lifetime value equation often has these variables:

Frequency of purchase… Supers buy a lot and often!

Average gross margin per purchase… Supers are willing to pay a premium.

Years in the category… Supers have the highest category lifespan.

Churn/retention rate… This is very low at the category level for Supers.

Word of mouth… This is exponentially higher for Supers, who are the best evangelists.

Categories cross-sold… Super of 1 = Super of 9 categories

Most companies go through the first four variables, less go through the last two. This is where the Superconsumer drives the most value, but is often the least measured.

The signal for customer profitability and sales and marketing efficiency is LTV / CAC.

Lifetime value of the customer divided by customer acquisition cost.

When you prioritize spending the lion’s share of your efforts and resources educating and marketing to your Superconsumers, the lifetime value of your customers goes up (because your Supers spend more with you, more often) while simultaneously bringing your customer acquisition cost down (you’ve found your Supers, now you just need to give them more things to get excited about).

Numerator goes up. Denominator goes down.

And when you do this successfully, that’s monayyyyyyyy.

The MoviePass Debacle

When you don’t know who your Supers are, or if you don’t have a business model that incentivizes Superconsumer behaviors, you end up in a bit of a mess.

Sort of like what happened to MoviePass.

In 2016, a startup called MoviePass launched as a subscription-based movie ticketing service. The Verge summarized the business model by saying “the subscription plan offered users a movie ticket a day—access to films in any theater, in any market—for less than $10 a month, ensuring the company would spend most on its customers than they would pay to use the service.”

Said differently, MoviePass was (unknowingly) engineered to be the inverse of LTV/CAC. The company had one pricing model ($10/month), and as a result, LTV couldn’t go any higher. It was capped. There was no path for Superconsumers of movies to spend more, and more, and more (*Pink Floyd shout* MONAYYYYYYYY!). And yet, the company’s customer acquisition cost was infinity, because Supers can watch as many movies as they want.

On CNBC in 2018, Pirate Eddie called this the equivalent of “inviting Homer Simpson to a buffet business model.”

It’s all you can eat—which is what led to the company’s demise in 2019.

Had MoviePass used movie Supers as “loss leaders,” they might have been onto something.

If you’re a movie Super, what else are you probably a Super of?

Movie snacks like popcorn and candy?

Limited edition movie posters, action figures, t-shirts, and memorabilia?

Vintage movies and special, unreleased behind-the-scenes content?

Recliner chairs?

Home theatre equipment?

Expandable pants?

A little brainstorming reveals a handful of tangential categories where MoviePass could have either 1) created higher-ticket offerings for their Supers to move up the value chain and spend more money with the company, or 2) created partnerships with other category kings and queens to reduce their customer acquisition costs. Surely Hershey’s or Mars would have loved to have put a candy store in the movie theatres and allowed MoviePass customers to swipe snacks to their credit cards through the app.

Conversely, if Hershey’s or Mars was using this Superconsumer framework themselves, they could have acquired MoviePass and used movie Supers to drive their own businesses—which is exactly what Amazon just did by acquiring MGM Studios for $8.45 billion (and was the same rationale behind them acquiring Whole Foods back in 2017 for $13.4 billion).

A Superconsumer of 1 category is also a Super of 9 others.

Microsoft Office’s Legendary Data Flywheel

There is almost no greater example of how powerful this Superconsumer framework is than the story of Microsoft Office. Former Microsoft President, Mike Maples Sr. tells the story in full on Pirate Christopher’s podcast.

In the ‘80s and ‘90s, Microsoft was one of the most powerful and influential companies in the world. But it was nowhere to be found in the new and emerging category of “apps,” which lived on people’s personal computers and were bought as software (with disks, if you remember those things).

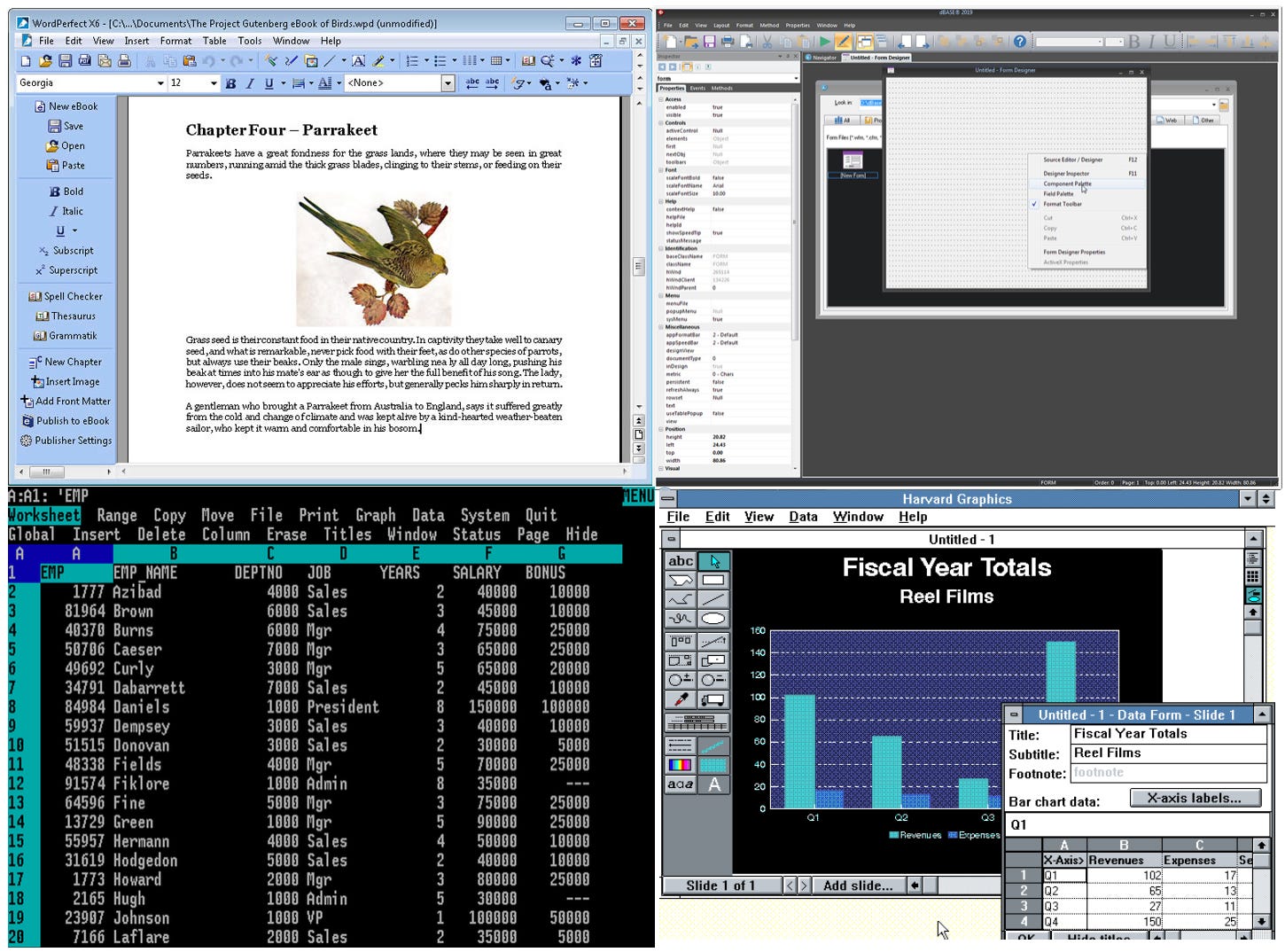

The leader in the category for Word Processing Apps was called WordPerfect.

The leader in the category for Database Apps was called dBase.

The leader in the category for Presentation Apps was called Harvard Graphics.

And the leader in the category for Spreadsheet Apps was called Lotus 1-2-3.

Each one of these companies existed in separate categories. And each one of these apps required a completely new and different understanding of the product. WordPerfect didn’t look anything like dBase, which was practically Spanish to someone used to building presentations in Harvard Graphics, which was separate from Lotus 1-2-3.

Here’s a little blast to the past, with a glimpse as to how different each application looked:

Over time, Microsoft did what most large and successful companies do: build competitive products in each subcategory with the hopes of out-competing each category king at their own game—all under the assumption that customers will stay loyal to the Microsoft brand.

And, like most companies that conflate branding and category design, they failed in every single subcategory.

Nobody was buying Microsoft’s knockoffs.

Until one day, Mike Maples Sr. went on a business trip.

A region head explained to him that he had been running a special promotion to try to deal with the fact that Microsoft was effectively a category jester in every single one of these individual app categories. The promotion was a bundle: if the customer buys 3 or 4 of these apps at the same time, they get a big discount.

And in this tiny region, sales were starting to take off.

So Mike Maples Sr. came back to HQ with an idea. More specifically, a new category idea.

Instead of trying to build individual products in individual categories, why not combine all the products into one new category? Instead of building a word processor that competes in the word processing category, or a presentations application that competes in the presentations category, Microsoft and Mike Maples Sr. named & claimed a new category which they called Office Productivity. Because if you use an excel spreadsheet then you’ll probably also use a presentations application, and you’ll also probably use a word processor, and you’ll probably also need to use a database application.

A Super of 1 is a Super of 9.

In addition, and flawlessly executing The Magic Triangle, Microsoft also started building a new form of technology called DDE: Dynamic Data Exchange. This allowed all the applications to be connected, so when a user makes a change in the database app, that change is reflected in the connected presentation, or word document, or spreadsheet.

By integrating all the products together into a suite, they could minimize the learning curve that came with each individual category of application. Instead of having to learn 4 different products from 4 different companies with 4 different user interfaces, you could use 1 suite from 1 company and have all your information integrated together.

They called it Microsoft Office.

The big ah-hah for Microsoft was that Office Productivity Software is all the same customer.

The company intuitively understood that a Super of 1 would be a Super of 9. And they nailed The Magic Triangle, innovating on all 3 sides:

Product Design: All the apps had the same UX and data can be easily integrated and shared throughout the ecosystem.

Company/Business Model Design: Instead of buying 4 different products, you could pay for 1 suite (bundle) that was also cheaper, easier to learn, and stickier.

Category Design: Office Productivity software isn’t the sum of the parts (word processor + databases + spreadsheets + presentations). It’s a new and different category of office tools wherein you don’t actually want to have one or the other. You want them all.

Two years later, the game was over.

Microsoft Office became the dominant business technology suite, and WordPerfect, Harvard Graphics, dBase, and Lotus 1-2-3 fell apart. Microsoft applications (like Office, excluding operating systems) revenue was ~$0.6 billion in 1990. By 1997, Microsoft’s applications revenue was nearly 10x higher at ~$5.4 billion. And even still today, MS Office is the undisputed category king of office productivity software. Even Google Docs, which is a head-on competitor and 100% free, has hardly made a dent in Microsoft’s 30-year category dominance.

How To Find Your Supers—And The 9 Other Categories They Are Also (Probably) Interested In

Like a roaring crowd, the business world is obsessed with fighting over market share.

In this predefined category, who is going to win?

But when you decide to focus on wallet share instead of market share, suddenly you aren’t competing. You’re focused on creating. Expanding. Growing. You’re focused on finding and evangelizing your Supers (*Pink Floyd shout* MONAYYYYYYYY!), meaning your competition is irrelevant.

Because if you understand that a Super of 1 is also a Super of 9 other categories, then you can see revenue.

You can see new and different categories worth exploring.

Our friends over at Category Design Advisors call this “finding your Adjacent Possible.” Often the last people to “get” that change is coming are the incumbents who will be most affected by it.

Which also means, long before companies realize they’re the next WordPerfect or Harvard Graphics, you can *see dead businesses.*

Here’s how:

1. WHO?

Every Superconsumer has an origin story.

We like to think of Supers the same way Marvel thinks about superheroes. How did Peter Parker become Spiderman? He’s bitten by a radioactive spider. So, how did Suzie Swiffer become a Superconsumer of Swiffer mops and dozens of other all-in-one home cleaning supplies? If you take the time to ask her (or any Super) how they became the way they are, they will tell you: maybe Suzie used to be really dirty, never cleaned her apartment, and then one day behind the refrigerator she discovered an entire family of spiders, spider eggs, and millions of baby spiders crawling up and down the backs of the cabinets. She was terrified and disgusted, and vowed to never slack on her home cleaning habits ever again!

Other quick examples:

“Why am I a health nut? My dad had a heart attack.”

“Why am I a Bitcoin believer? I watched my family lose everything in the 2008 housing crisis and became distrustful of the government and our banking system.”

“Why am I a watch collector? My mom used to fix and repair watches in our garage growing up and some of my fondest memories are of the long afternoons I’d spend in there helping her repair these beautiful gold and silver watches.”

“Why am I an engineer? My mom worked at IBM and she used to take me to work, where I became fascinated by computers.”

The origin story of your Supers is incredibly important, if for no other reason than to help you stop seeing this person as a “Customer” (a buying unit you think of transactionally) and start seeing them as a loyal, emotional, highly intelligent enthusiast of the types of products and/or services you hope to create in the world.

More tactically, when you understand how your Supers became who they are, you will also understand their drivers, their aspirations, and why they care so deeply about whatever it is they’re a Super of. After all, you can’t see the full category constellation Superconsumers have unless you also have deep empathy for the desires, aspirations, and life quests that drive them in the first place.

2. WHERE?

Once you know who your Supers are, the second question is, “Where are they?”

We call these Supergeos. (Check out what we wrote in HBR about Supergeos for more info.)

No data is more powerful for your business than finding local regions with clusters of your Supers. For example, a while back, Ben & Jerry’s discovered that 3,000 grocery stores (<10%) drove half the sales of all Cherry Garcia SKUs. That meant that advertising in 90% of grocery stores in America was largely a waste of money.

Or let’s say you’re a startup trying to figure out where to launch your lightning strike. Wouldn’t it be helpful to launch your startup in a local area that is hot and heavy with Superconsumers?

This is an actual category treasure map we’re talking about here folks!

Supers are evangelists for your movement.

The more your point of view is shared, the more word-of-mouth marketing you will generate. And with enough word of mouth, in a concentrated space and time, your category will tip—and take your brand on the ride to your new island (wherein you are Category King).

The most effective way to find where the Supergeos are (where your Supers hang out) is by converting your customer data into a per-capita metric by zip code. If you can take the data you have and localize it, all of a sudden you have context as to why people are behaving the way they are based on proximity.

For example, if you’re Microsoft gearing up for a new Xbox launch, the first thing you want to know is where in the world your Xbox Supers are—where are the Supergeos? By converting customer credit card data into anonymized, localized data, you might discover there are tons of Supers in various small towns down south and in the northwest of the US (places where there isn’t much to do except play video games). Great! Those become the areas where Microsoft and Xbox should spend more time, energy, effort, and money because those are the customers most likely to not just buy one game, but buy three. And not just buy three regular games, but three deluxe launch packages that sell at a 70% premium.

Similarly, Microsoft and Xbox would also want to ask, “What else are our Supers, Supers of?”

It’s not rocket science. If you’re a Super of Xbox games, you’re probably also a Super of:

Fast food

Energy drinks

At-home fitness

Live eSports

Colorful mood lights and movie projectors

Streaming devices, cameras, keyboards, etc.

Eyecare (contacts, eyeglasses, blue light glasses)

Drones, smartwatches, etc.

The next logical thing for Microsoft to do would be to not only target these Supergeos, but forge partnerships with other businesses that align with the interests of Xbox Supers. Microsoft might do a launch partnership with Sonic in these Supergeos, or a co-branded marketing campaign with all local Best Buys. This concentrates the marketing and drives word-of-mouth marketing, but more importantly, puts the right words in the right mouths.

In these Supergeos, Supers will be the ones evangelizing and talking about the big upcoming Xbox launch with Sonic or Best Buy.

And this becomes your leverage point to move the world.

3. WHEN?

WHO and WHERE are the lowest hanging fruit to find.

But WHEN is also a great place to hunt for Supers—however this can be a heavily analytic exercise. We are literally talking about what season, month, week, day, time of day, and second Supers shop compared to the rest of the category.

This matters because an incredible amount of conventional wisdom can be overturned here. For example, the conventional wisdom for sparkling wine is that the holidays (Christmas and New Year’s Eve) are the peak times to sell. Every company and brand of sparkling wine then spends most of their marketing and promotion dollars there—and ends up in a race to the bottom as a result.

What goes unnoticed in the sparking wine category is that Supers also buy surplus amounts on other holidays as well, notably Memorial Day until Labor Day.

That’s because Supers are the queens of incremental, clever use cases for the category. And sparking wine Supers are consumers who love cold, refreshing, bubbly alcoholic drinks—for any occasion. Said differently, they swap out beer for sparking wine whenever possible.

Understanding WHEN Supers buy can deliver a tremendous amount of operating profit, simply by targeting Supers during low seasonal periods when a company may not be covering fixed costs and avoiding high seasons where no one makes profit. This is where technology can start to add fuel to the fire. Some of the most sophisticated marketers use marketing mix modeling and multi-touch attribution analysis to figure out when their Supers buy and when other companies are quiet.

All of that said, artificial intelligence and machine learning aren’t great at understanding WHO your Supers are (origin story) or even WHERE they are (Supergeos). These are insights that have to be extracted from the data, not just the data itself.

But once you have these insights, now you can tell technology which direction you’d like it to keep exploring and learning. This is what answers the important question of, “WHEN? When are our Supers doing what they’re doing? Is there a time of year they’re most active? Is there a moment when they’re most likely to make a purchase? When in the year, quarter, month, week, day, second, should we be marketing to them?”

4. HOW?

How your Supers behave is paramount to understanding how to maximize lifetime customer value and happiness.

Do your Supers prefer subscribing monthly? Do they buy yearly?

Do they pay with credit card? Cash? Direct deposit?

Do they need to talk to someone in advance? How many touch points are required in order for them to convert?

What pricing tier/package are they most likely to start with? What’s the path for them to rise up the value chain?

How many purchase something additional after just one month? Three months? A year?

These are the sorts of questions that help you understand which points of friction in your business are most important to solve, first. Because the less friction there is, specifically for your Supers, the faster you are going to grow revenues—because again, your Supers are the ones spending 30% to 70% more than other less enthusiastic customers. For example, Amazon spends a considerable amount of time, money, and energy on continuously improving its return process. This is antithetical to the way many company leaders think. But Amazon understands that if returns are easy, the number one barrier for potential eCommerce Supers is removed.

Understanding the “shopping mission” is critical to unearthing the real reason why Supers buy whatever it is they buy. Imagine a Superconsumer buys five Apple TVs, yet only has two TVs in their household. How does that make sense? Well, what most companies don’t realize is that Supers are great gifters. They love the category so much they are often gifting it to other people they love. The other three Apple TVs were gifts to friends and family.

Pirate Eddie has seen this same phenomenon in numerous $1,000+ price tag consumer durable and IoT categories as well. Unfortunately, this purchasing behavior tends to get labeled as “strange” or even “extreme,” leaving most companies to neither understand nor exploit this as a strategy.

5. WHAT ELSE?

Now here’s where things start getting fun (the treasure map was right after all!).

What else are your Supers interested in? More specifically, if you know the 9 categories the Supers are Supers in, what might be the 10th category that has yet to be created?

This question becomes infinitely easier to answer once you’ve taken the time to gather data and insights from the preceding questions. The way to answer it is by playing The VC Game with your leadership team, and ensuring everyone has the above context walking into the session. Everyone should be able to recite various Supers’ origin stories. Everyone should have a sense of where the Supergeos are located. Everyone should have a working understanding of WHEN and HOW your Supers purchase and interact with their favorite products. And then, once everyone has this context, you can productively ask the question, “So what else does this Superconsumer want? What else would they be interested in, appreciate, and become excited about?”

This is the difference between optimizing for Wallet Share vs Market Share.

More importantly, this is how you design a new category breakthrough.

6. WHY?

Once you have a category breakthrough on your hands, the treasure cove keeps getting deeper.

For example, why do Honda Civics sell like crazy in Southern California? It’s because customers buy the base model and then trick them out like the cars in The Fast and the Furious movies.

Understanding this WHY is crucial because, if you’re Honda, wouldn’t it be smart to tap into that Superconsumer behavior?

Instead of these Supers (like most superheroes long before the world knows their name) hiding away in the shadows, why not evangelize them? Why not make their enthusiasm known to attract other Supers? Why not launch the Super Civic, which is nothing but the base-level Honda Civic except with hundreds of LEGO-like attachments and cosmetic additions you can purchase to build your car into your own unique expression? Why not create an XGames-like Super Civic event? Or a YouTube version of “Pimp My Ride” called “Pimp My Civic,” and celebrate the tuners who work on their cars? Or maybe (paying attention to the WHEN?), you learn your Supers would actually prefer to pay a monthly subscription renting cosmetic parts instead of buying parts outright—unlocking a whole new recurring revenue stream for the business.

Why do your Supers do what they do? What do they get excited about whatever it is they get excited about? Why do they love what they love?

Here’s a fun game. Which of these Supers of 1 = Supers of 9 data points is NOT true?

Supers of toothbrushes are Supers of hard candy

Supers of wine are Supers of gambling

Supers of business travel are Supers of botox

Supers of vitamins are Supers of insurance

Supers of skin care are Supers of shoes

Surprise, surprise. They are all true.

Outliers are oracles of opportunity.

Find that Why, and then instead of thinking of it as an outlier scenario, shine a spotlight on it.

7. HOW MUCH?

Is there a ceiling? If so, how much?

What’s incredible about Superconsumers is that if you can tap into their wants, needs, and desires, you’ll discover they are willing to pay a premo-premium for the things they just can’t get enough of. For example, a regular consumer of “scissors” might only spend $5 in the category over the course of a few years. But a Superconsumer of “scissors,” someone who loves scrapbooking or home projects, might spend upwards of $100 on scissors—maybe even $100 per month, multiple months out of the year (scissors with different handles and lengths, scissors for different kinds of projects, etc.).

What you’ll find is that when you evaluate your product or service through the lens of all customers (“What is the average person willing to pay for this?”), you end up underpricing your offerings AND undervaluing your Supers. Imagine if you were an Italian sports car fanatic and a new business came along and said, “It’s like a Ferrari but only costs $60,000.” You wouldn’t be intrigued. You’d be insulted. And on some level you would say to yourself, “I’m used to spending far more because I value the things I love.”

Instead, you want to price your products and services through the lens of your Superconsumers. For example, YETI proved you could create Superconsumers for outdoor coolers—a category that had largely been undervalued as little more than a big plastic container that holds cold stuff. Before YETI, people would buy a Coleman for $75 to $125. And so when YETI started charging $1,000 per outdoor cooler, they framed a new level of value in the “premium cooler” category they designed.

What do your Supers find most valuable, and how much would they be willing to spend for that delight?

They’ll pay accordingly.

8. WHAT NEXT?

All of this, together, is what creates your Data Flywheel.

A Super of 1 is also a Super of 9. Those 9 other tangential interests/categories are fruitful partnerships worth being explored and opportunities for new and different category breakthroughs to occur. Which means the more deeply you understand your Supers, and the more data you have about WHERE, WHEN, HOW, and WHY they do what they do, the easier it will be for you to spot the 10th category that doesn’t yet exist.

The purpose of the data flywheel is not to capture data for data’s sake.

The purpose of building a data flywheel for your business is to better serve your Superconsumers—which fuels profitability, which drives continued customer and data acquisition, which allows you to better anticipate the next compelling category (for your Supers) worth creating, all of which allows you to maintain your leadership position in the category.

Without your Supers, you are just another company churning & burning away, accelerating your customer acquisition costs but not actually increasing the lifetime value of your customers.

You are MoviePass.

Now, go find your Supers. Talk to them. Listen to their origin stories. Find your Supergeos. Increase profitability and find your next category breakthrough!

Arrrrrrr,

Category Pirates

PS: Help like-minded pirates “think different.”

If reading this opened your mind to new and different thinking, share it with a friend or click the ❤️ button on this post so more people can learn about Category Pirates.

This article led me to look into our customer data more deeply.

The majority of our customers are willing to spend 1-2k on a product, but there are other ‘tiers’ of customers who are willing to spend 3-5k and even ones who are are willing to spend 10k+.

The ones who are willing to spend more are also the ones who use our platform much more frequently.

We have been offering the same value proposition to all of them 🤦

Now we’re going to play the VC game to find out how we can leverage our Superconsumers.

Thanks Category Pirates!

I'm very curious: have you guys done a superconsumer analysis on category design supers? I'd be very curious to hear about what other categories they're supers in. I myself would probably be considered a category design super (I think I've read most articles in this substack, sometimes several times lol) and of course am an active member in the Category Thinkers slack group.