How To Leverage Superconsumers To Accelerate Your Data Flywheel And Uncover Opportunities

Without your Supers, you are just another company churning & burning away.

Dear Friend, Subscriber, and Category Pirate,

This Category Design Tip is about finding your category’s Superconsumers and leveraging the data they naturally generate.

As we explain in our mini-book A Super Of 1 Is A Super Of 9, a Superconsumer is the kind of person who knows your category better than anyone else—and is willing to spend 30% to 70% more with you. Superconsumers (and the data associated with them) are essential to unlocking exponential growth for your business. When you gather and leverage this information through a data flywheel, you can forecast the future of the category.

To chart a new category course (our mini-books are the best maps), hop aboard The Pirate Ship and subscribe below:

The Data Flywheel

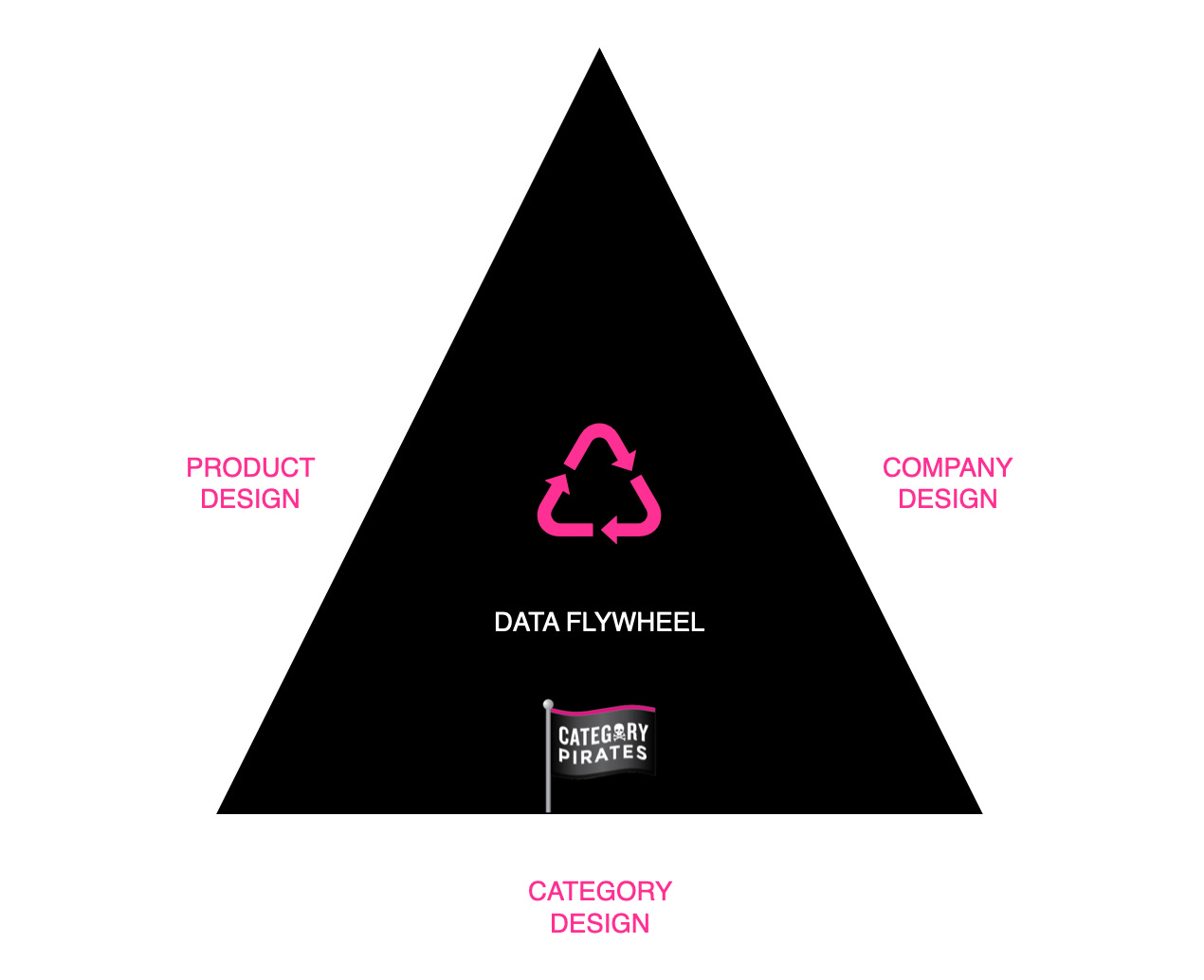

The elite Category Kings & Queens recognize that each area of The Magic Triangle generates data about their Supers and the future of the category.

The product

The company & underlying business model

And the company’s leadership position in their chosen category

The purpose of the data flywheel is not to capture data for data’s sake.

The purpose is to better serve your Superconsumers. This fuels profitability, which drives continued customer and data acquisition, which allows you to better anticipate the next compelling category worth creating. And it allows you to maintain your leadership position in the category.

The big question is, “How?”

The story of Microsoft Office shows the power of the Superconsumer + data flywheel framework.

In the ‘80s and ‘90s, there were 4 different leaders in work software that existed in separate categories.

The leader in the category for Word Processing Apps was called WordPerfect.

The leader in the category for Database Apps was called dBase.

The leader in the category for Presentation Apps was called Harvard Graphics.

The leader in the category for Spreadsheet Apps was called Lotus 1-2-3.

Microsoft was one of the most powerful and influential companies in the world. But it was nowhere to be found in the new and emerging category of “apps,” which lived on people’s personal computers and were bought as software. Microsoft’s leadership realized that by integrating all the products together into a suite, they could minimize the learning curve that came with each individual category of application.

Instead of having to learn 4 different products from 4 different companies with 4 different user interfaces, you could use 1 suite from 1 company and have all your information integrated together.

They called it Microsoft Office—and it nailed The Magic Triangle, innovating on all 3 sides:

Product Design: All the Office apps have the same UX and data can be easily integrated and shared throughout the ecosystem.

Company/Business Model Design: Instead of buying 4 different products, you can pay for 1 suite (bundle) that’s cheaper, easier to learn, and stickier.

Category Design: Office Productivity software isn’t the sum of the parts (word processor + databases + spreadsheets + presentations). It’s a new and different category of office tools wherein you don’t actually want to have one or the other. You want them all.

The big ah-hah for Microsoft was that Office Productivity Software is all the same customer. The company intuitively understood that a Super of 1 would be a Super of 9.

Use these questions to find your Supers and build out your data flywheel:

Who are your Superconsumers? when you understand how your Supers became who they are, you will also understand their drivers, their aspirations, and why they care so deeply about your company/category.

Where are your Superconsumers? No data is more powerful for your business than finding local regions with clusters of your Supers.

When do your Superconsumers buy? We are literally talking about what season, month, week, day, time of day, and second Supers shop compared to the rest of the category.

How do your Superconsumers behave?

Do your Supers prefer subscribing monthly? Do they buy yearly?

Do they pay with credit card? Cash? Direct deposit?

Do they need to talk to someone in advance? How many touch points are required in order for them to convert?

What pricing tier/package are they most likely to start with? What’s the path for them to rise up the value chain?

How many purchase something additional after just one month? Three months? A year?

What else are your Supers interested in? This is whatever else they would be interested in, appreciate, and become excited about.

Why do your Supers do what they do? Think about why they get excited about whatever it is they get excited about. Why do they love what they love?

How much are your Supers willing to pay? Consider what your Supers find most valuable, and how much would they be willing to spend for that delight.

All of this, together, is what creates your data flywheel.

Once you have your data, there’s a way to use it to spot weird future exponential category opportunities—and it’s called Category Science.

Become A Category Designer

Want to unlock 50+ mini-books on Category Creation and Category Design, and receive new mini-books straight to your inbox?

Hop aboard!

Arrrrrrr,

Category Pirates

have you guys got a list of questions that we can ask superconsumers to inform our strategy?

This is a little OT, but if American Dad’s Roger Smith was a pirate, would Klaus Heisler be the parrot