Competition Derangement Syndrome: How Competition Ends High-Potential Companies & How To Cure It With Strategy Therapy

Your biggest competition is thinking you have competition.

Arrrrr! 🏴☠️ Welcome to a 🔒 subscriber-only edition 🔒 of Category Pirates. Each week, we share radically different ideas to help you design new and different categories. For more: Dive into an audiobook | Listen to a category design jam session | Enroll in the free Strategy Sprint email course

Dear Friend, Subscriber, and Category Pirate,

In 2005, the beer industry was locked in a price-slashing battle.

It began when Anheuser-Busch, the Category King, dropped its prices in an attempt to stop Miller Brewing Company from gaining more market share. Miller attacked back. The company's executive vowed to "adjust any relative price gaps where competitor discounts have impacted…sales." One by one, other beer companies followed suit, each slicing into their margins to keep up in a race to the bottom they neither wanted nor could afford.

The race to the bottom was on! 🏎️

Prices spiraled.

Profits sank.

The aftermath was as predictable as it was tragic. For a full year, the beer industry's profits evaporated like spilled beer on a hot summer day. This wasn't just a loss for Anheuser-Busch or Miller. It was a self-inflicted wound across the entire sector, all because of a single competitive maneuver.

At the heart of this debacle wasn't a corporate rivalry—it was a chronic disease.

The board at Anheuser-Busch finally had enough, but they didn't know how to stop the fight.

So, they decided to ask for help. Anheuser's board members included a number of CEOs and senior executives from Emerson Electric, Enterprise Rent-a-Car, and Purina—all legendary St. Louis companies. Each person said they had a great experience with The Cambridge Group (Pirate Eddie’s old firm), which was the best of the best at identifying new demand vs. competing for old demand. The firm asked Pirate Eddie to lead the work at Anheuser-Busch.

It was one of the strongest cases of Competition Derangement Syndrome (CDS) he had ever seen.

For example:

Miller had launched an “energy drink beer.” Anheuser knew it was a bad category design, but they still went to a brand manager and said, “Here’s a few million bucks. Go kick their asses.”

One of the senior executives called Pirate Eddie and asked for the address, date, and time of The Cambridge Group holiday party, so they could send 40 cases of Anheuser-Busch beer to ensure no one consumed a competitor's beer.

Anheuser routinely bought numerous Super Bowl advertising slots years in advance, because they wanted to make it as hard as possible for any beer competitor to get air time.

There was a high degree of skepticism and a desire to revert back to CDS. After all, Anheuser had the world’s best-selling beer and a portfolio of 50-60 different brands…

…until Pirate Eddie created and presented a seminal category science slide.

(Category Designers are always looking for data. Especially weird data. That's often when legendary breakthrough ideas to drive revenue and innovation hide.)

The weird data at Anheuser was an 'international bitterness unit' (IBU), which is the quantity of hop resin or alpha acids in a beer. Pirate Eddie plotted all of the top brands of beer by market share on a spectrum of IBUs. As he presented this slide in St. Louis, he shocked the Anheuser executives with a few facts:

68% of US beer volume was between a narrow range of 6 to 10 IBUs.

CDS led them to focus on competitors that were only 1 IBU away…

…yet virtually most import/craft beers had +60% higher IBUs

(In Category Design, we call data like this a “missing” hiding in plain sight.)

This slide also explained why the company's most recent new product launch, Budweiser Select, failed despite spending $100 million dollars on marketing and having Jay-Z as the ‘brand manager.' The IBU chart showed that from a bitterness perspective, Budweiser Select tasted no different than Bud Light. (And also because the category makes the brand. Categories are about customers—their problems, needs, wants, and opportunities.)

Now, Anheuser-Busch had some of the greatest marketers Pirate Eddie had ever met.

They had a $1.5 billion marketing budget per year. They had world class distribution into 550,000 retail outlets. Their marketing created culture.

You might remember a few of these campaigns:

But no matter how great the marketing, it could not help them with the fact that Bud Light was only 1 IBU different than Miller Light. (Translation: Bud Light was not different.)

Anheuser realized they had a severe case of CDS—and the only cure was brutal honesty and radical courage.

Pirate Eddie and the team were brutally honest about the company.

Product: “All your beers are wedding caked on top of each other taste-wise.”

Competitors: “Miller and Coors aren’t the problem. Wine and spirits are.”

M&A: “You can’t buy your way into wine/spirits. Integration is too hard.”

Taste: “You have to accept that taste matters as much as image.”

But the Anheuser team also needed to be radically courageous.

Innovation: “Innovation can work, but it has to be radically different.”

Strategy: “Compete with spirits via a beer business model.”

Brand: “Mega-brand Bud Light into a sweeter, spirits palate.”

Pricing: “Price the mega-brand +30% higher.”

This category strategy therapy session shook the Anheuser team. However, it created the foundation for the Bud Light mega-brand strategy and an entirely new category. Rather than write a billion-dollar check to a legacy spirits brand, Pirate Eddie and the team suggested Anheuser:

Launch Bud Light Lime, appealing to a sweeter palate

…as a bridge to launch Bud Light Lime Lime-a-Rita, a Margarita mix

…and do this all via a beer business model of cans/bottles

…leveraging the world’s biggest and historically macho brand

Bud Light Lime was a first—a new and different category. Different forces a choice, while "better” forces a comparison. And category leaders do not compare. Others compare themselves to Category Queens.

But Anheuser's revenue prevention department was out in full force.

(In some companies, the revenue prevention department is meaningfully larger than the revenue production department.)

Anheuser's head of innovation was told, “If you ever utter the words Bud Light Lime again, you’ll be fired on the spot!” The head of brewing said, “You can’t put Bud Light Lime in a clear bottle!” The sales force said, “You can’t break line pricing and make this +30% higher!”

Still, the executive team took a risk.

(It takes courage to be legendary.)

The Bud Light mega-brand strategy generated $1.5 billion dollars of margin accretive revenue within a few years of launch.

Anheuser’s market share went up, margins expanded, and more importantly, the beer category grew significantly. To this day, Bud Light Lime remains the most successful new product launch in the history of the company.

Let that sink in.

Bud Light Lime remains the most successful new product launch in the history of the company.

Here’s how Bud Light Lime drove growth quickly after launch.

And here are the slides Anheuser shared with investors to explain the new Category Design and how it was winning in spirits via a beer business model.

Different wins. Always.

Anheuser was willing to face brutal honesty and embark on a crazy category design strategy that required massive courage. This cured its extreme case of CDS. Which allowed the executives to be different.

Most importantly, it ended the price battle and expanded the entire beer category.

Competition Derangement Syndrome is a condition in which decisions are made not out of strategic insight or innovative thinking but out of an obsessive, knee-jerk reaction to the competition.

Many CEOs are more focused on competition than customers and categories.

They're stuck in a CDS cycle of thinking: We have to catch up. We need to crush them with a better strategy/feature/product/campaign. They did it, so we have to do it.

To lay the beer price battle blame solely at Anheuser-Busch’s feet would be to miss the larger diagnosis. Like many companies, it was in the grip of Competition Derangement Syndrome. The executives didn't just choose to slash prices; they felt compelled to—driven by a disease that clouded their strategic vision and caused them to act in a way that was contrary to their own and the industry’s best interests.

When a company and its leaders are suffering from CDS, each move is more about countering the other than genuinely breaking new ground.

The fallout?

It's not just the millions poured into attack ads or the dizzying price slashes. It's the missed opportunities for innovation, the lost chances to lead the market into uncharted territories, and the lost category potential of a radically different new market. When companies get caught up in the CDS cycle, they don't just risk their profits or market share.

They risk their futures.

OpenAI, the fastest-growing tech startup in history, could have competed with Google in the search category. If the team suffered from CDS, they might have declared they were:

Better search

Search 2.0

Next generation search

Instead, OpenAI declared a new ($45 billion) category called “generative AI.” That category design, plus a truly massive exponential breakthrough product and a freemium (not advertising) business model got the company to $2B in revenue in seven years—less than three years from the launch of its first product.

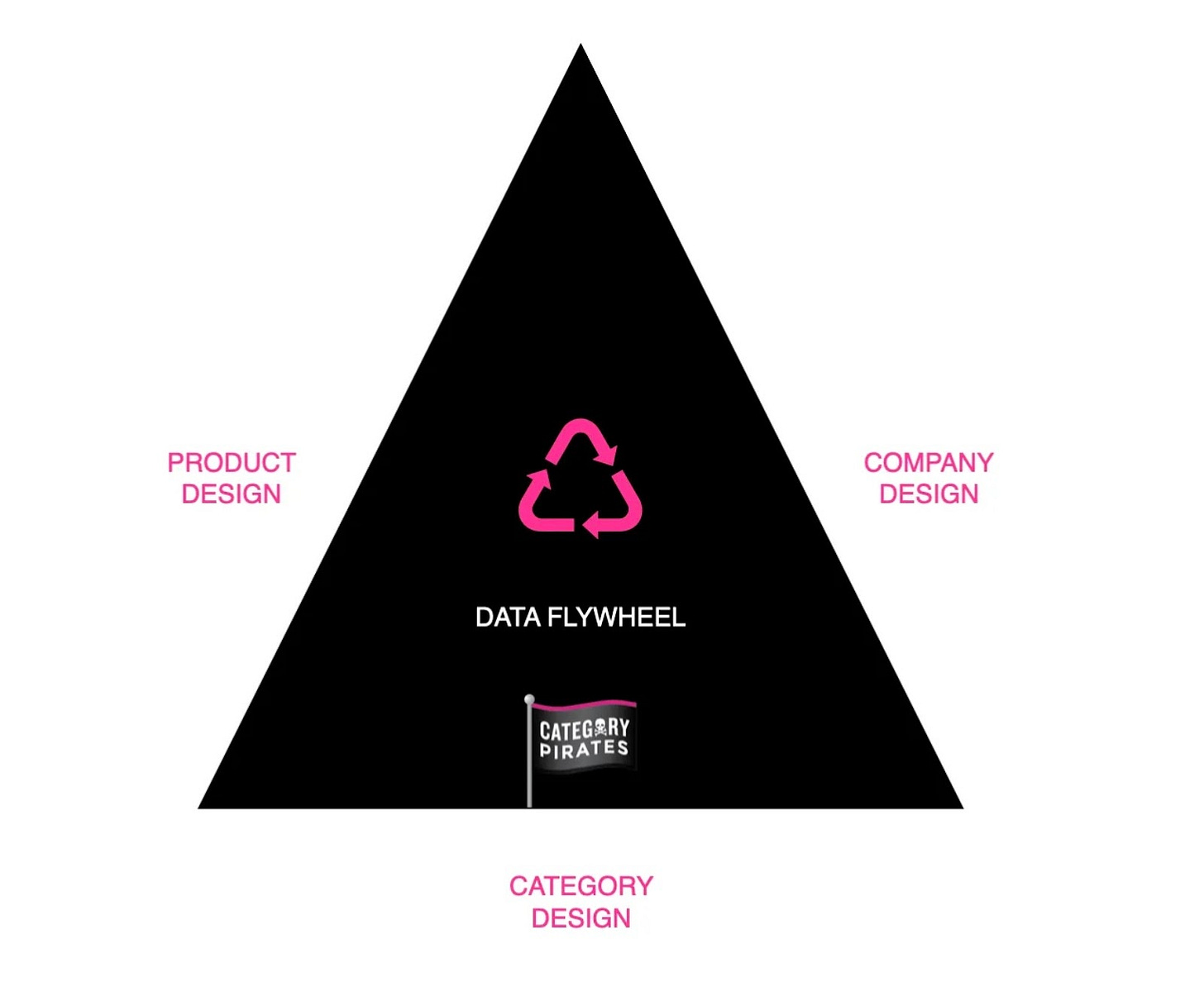

OpenAI prosecuted the Magic Triangle flawlessly.

Just like Anheuser-Busch did with Bud Light Lime.